Last Updated on November 24, 2022 by underanewsun

Disclosure: Some, but not all, links on this post are affiliate links. Any purchases made on affiliated sites result in compensation to our website (at no additional cost to you).

I have good news and I have bad news. The good news? You’re planning a visit to the U.S. Yes!

The bad news? Although U.S. sales taxes and VAT are similar in some respects, they’re also very different. Countries charging VAT allow foreign tourists to request refunds on the taxes they’ve paid on certain purchases.

Sales tax refunds are not, in general, available to foreigners visiting the U.S. There are, however, two exceptions to this (discussed later).

Why can’t foreign tourists request sales tax refunds in the U.S.? In short, it has to do with who charges these taxes.

Before discussing U.S. consumption taxes, though, it will be helpful to first review the various levels of government in the U.S.

Image courtesy of argus456/Pond5.

U.S.A. Government Hierarchy

Levels of government in the U.S.A.

The U.S. federal government is:

- The U.S.’s national government

- Superior to all other levels of government

- Based in Washington, D.C.

State governments

- There are 50 U.S. states, each with its own capital city and government

- The State of New York’s capital city, for example, is Albany.

- States may create any laws which do not violate federal laws

- State governments are subordinate to the federal government

- State governments are superior to lower levels of government

County governments

- U.S. states are divided into counties*

- Counties are composed of cities, towns and villages

- New York State, for example, has 62 counties

- Each county has a capital, known as the county seat

- County governments are subordinate to the state & federal governments

- County governments are superior to local governments

- *Note: Louisiana refers to its counties as parishes

Local governments

- Cities, towns and villages are called municipalities

- Each municipality has its own government

- Local governments are subordinate to all levels of government above them

| Location | Type of consumption tax | Tax imposed by |

|---|---|---|

| USA | Sales tax | State & local governments |

Who charges sales tax in the U.S.A.?

U.S.A. sales taxes vs. VAT

USA consumption taxes

In the 160+ countries that charge VAT1, it is the national government who imposes this tax.

When tourists visit VAT-charging countries, they may request refunds of the VAT they’ve paid on qualifying purchases. Those refunds are processed by a country’s national government.

In the U.S., however, the federal government never charges a consumption tax. Ever.

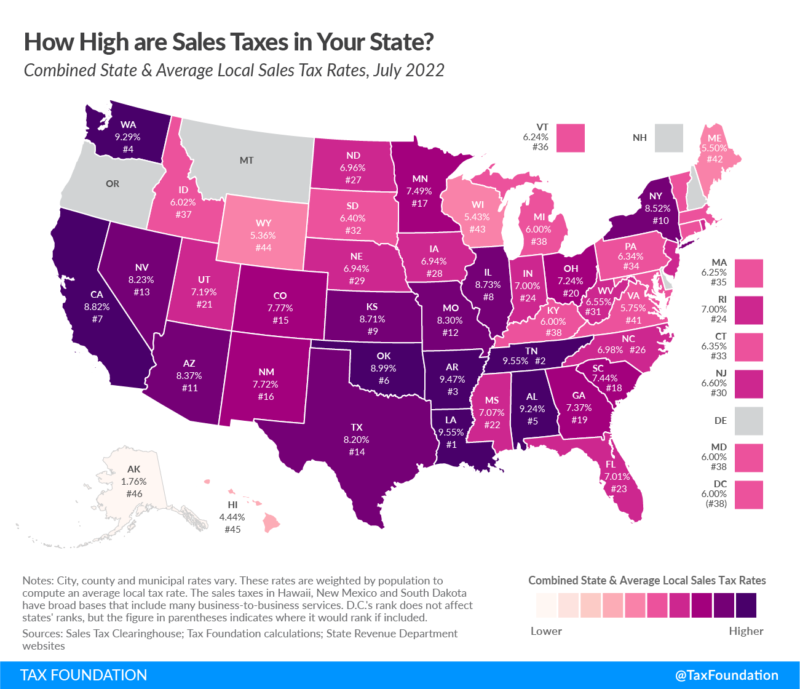

Instead, each state decides whether to charge a sales tax and how much it should be.

50 states = 50 different sales tax rates!

Not only that, county and local governments as well as other government entities may also charge their own taxes.

Here’s how the State of Illinois defines sales tax:

” ‘Sales tax’ is the combination of all state, local, mass transit, home rule occupation and use, non-home rule occupation and use, park district, county public safety and facilities, county school facility, and business district taxes. It is imposed on a retailer’s receipts from sales of tangible personal property for use or consumption.”

State of Illinois Revenue Dept.2

Thus, there is no uniform national “USA sales tax.” There are, however, a multitude of state and local taxes that, collectively, are referred to as sales tax.

In the U.S., every level of government except the federal (national) government may impose this tax.

Big City, Small City

Two examples

New York City

New York City is a city within New York State.

Shoppers in New York City pay 8.875% in sales tax.3

This 8.875% tax breaks down to:

- 4% New York State tax

- 4.5 New York City tax

- 0.375% Metropolitan Commuter Transportation District surcharge

- Total: 8.875%

What is the Metropolitan Commuter Transportation District surcharge? It’s a tax benefiting the Metropolitan Transportation Authority (MTA), the entity which runs NYC’s public transportation. It is charged within NYC and several counties near NYC.

If you leave New York City and shop elsewhere in New York State, the state tax remains 4%, but the county and local taxes will differ. In Saratoga County, New York, for example, the tax is 7% (4% state tax + 3% county tax).

McCook, Nebraska

The small city of McCook, Nebraska demonstrates how complicated sales tax in the U.S. can be.

In McCook, you’d pay a 7% tax:

- State of Nebraska tax: 5.5%

- Red Willow County tax: 0

- McCook tax: 1.5%

- Total: 7% 4

In McCook, you’d pay the state and city taxes, but zero in county taxes.

Fun Fact– You’re probably familiar with New York City’s five boroughs: Manhattan, the Bronx, Brooklyn, Queens and Staten Island. But did you know each is also a county? Their county names are: New York County (Manhattan), Bronx County (the Bronx), Kings County (Brooklyn), Queens County (Queens) and Richmond County (Staten Island). All five share the same sales tax rate.

How foreign tourists can save on sales tax

Options to save money

Money-Saving Option 1: Don’t pay the tax

Very simple, right? Just don’t pay it. Easy.

But you said I have to. Correct! You do have to pay it…but only if one exists.

You see, of the 50 U.S. states, four do not charge any consumption taxes whatsoever, including local taxes.

These states are:

- Delaware

- Montana

- New Hampshire

- Oregon

Alaska did not make the list, but deserves honorable mention. Alaska’s state government does not impose a sales tax, but some local governments do. Even so, taxes on purchases in Alaska average out to about 1.76%.5

I once traveled from New York to Delaware specifically to buy computer equipment tax-free.

When I asked the saleswoman whether people come from farther away than New York to shop tax-free in Delaware, she told me about a man who flew in from California to buy a $20,000 watch.

Using Los Angeles’s current sales tax rate of 9.5%, the man would have paid $1,900 in tax, for a total of $21,900.

It was cheaper for him to fly coast-to-coast than pay California’s taxes! With that said, U.S. sales taxes are still much lower than most countries’ VAT rates.

Money Saving Option 2: Shop in Texas & Louisiana

Earlier we mentioned there are only two exceptions when it comes to sales tax refunds for foreigners. They are: Texas and Louisiana.

Of the 46 states that charge tax, only Texas and Louisiana offer foreign visitors refund programs.

These refund programs are similar to requesting VAT refunds in other countries with one big difference: U.S. federal government agents (i.e. airport customs officers) are not involved in validating your refund paperwork. Instead, refunds are handled by private companies.

Texas sales tax refunds for foreign visitors

Texas authorizes several companies to process refunds. These companies handle refunds at offices throughout the state. To qualify for refunds, purchases must be made at participating stores.

Louisiana sales tax refunds for foreign visitors

The process is similar in Louisiana. To be eligible, purchases must be made from stores that are members of the Louisiana Tax-Free Shopping (LTFS) program.

After presenting your passport to the retailer, you are given a voucher. You can redeem the voucher(s) at an LTFS Refund Center.

Image courtesy of Robuart/Pond5.

How to determine your destination’s tax rate

Planning tools

Use an online calculator

- For the most specific results, use an online calculator.

- You’ll need to input a specific address to use this calculator.

Range table

- Don’t need ultra-specific results? Consult a tax range table.

- This method gives you a general idea of rates, but be aware taxes can vary within a county and, sometimes, even within a city.

Look up rates on your own

For most places, just search: (city, state) + sales tax rate.

Sample searches:

- Seattle, Washington sales tax rate

- Los Angeles, California sales tax rate

Tip: Be sure your search results show the tax rate for your specific destination and not just the state. For example, if you search Houston, Texas sales tax rate, your result should specifically state Houston, Texas and not just Texas. Don’t forget, sales tax = state tax + local taxes.

How to calculate sales tax

Simplest method

In most cases, sales tax is not included in the sales price; it’s added when completing your purchase.

To calculate the total cost including sales tax, use:

Item cost x (1 + tax rate)

Reminder: Convert the tax rate to decimal form. New York City’s 8.75% rate, for example, becomes 0.0875.

Example 1:

- Item cost = $112

- Tax rate = 8.75%

- Formula: Item cost x (1 + tax rate)

- $112 x 1.0875 = $121.80 (total cost, including tax)

Example 2:

- Item cost $112

- Tax rate = 7%

- Formula: Item cost x (1 + tax rate)

- $112 x 1.07 = $119.84 (total cost, including tax)

Notes/Citations

- https://www.imf.org/en/Publications/fandd/issues/2022/03/b2b-value-added-tax-continues-to-expand

- https://www2.illinois.gov/rev/questionsandanswers/Pages/139.aspx

- https://www1.nyc.gov/site/finance/taxes/business-nys-sales-tax.page

- https://www.avalara.com/taxrates/en/state-rates/nebraska/cities/mc-cook.html

- https://taxfoundation.org/state/alaska/